Create: Update:

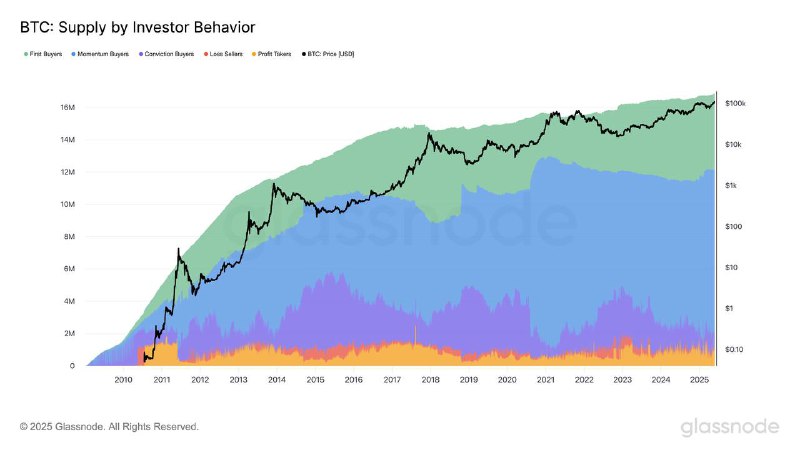

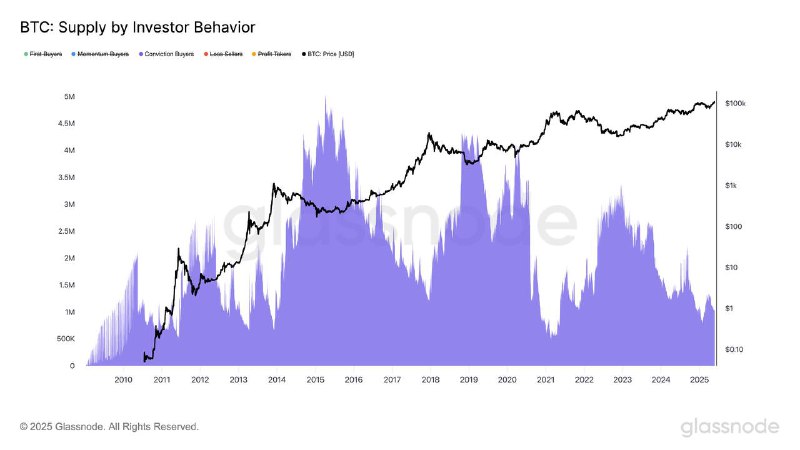

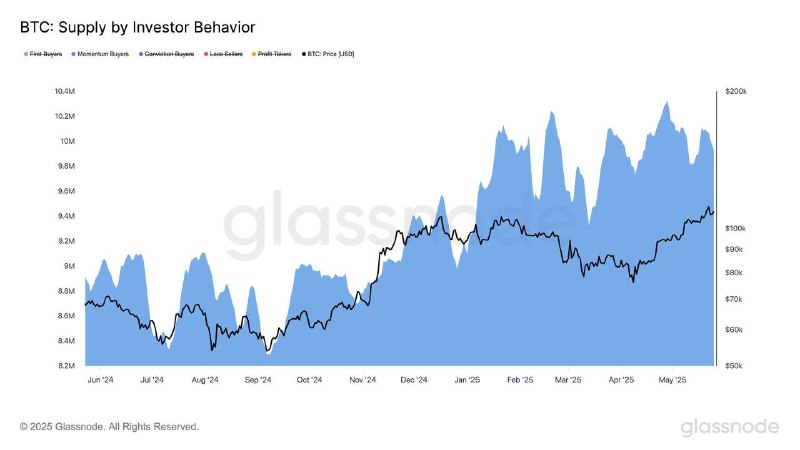

To navigate market cycles effectively, it's not enough to track price. You need to understand who is driving those moves.

Glassnode’s latest visualization segments BTC, ETH, and ERC-20 token supply by investor type — based on real on-chain spending behavior. This lets you identify whether market moves are driven by:

→ Long-term conviction

→ New capital inflows

→ Short-term momentum

→ Panic selling

Three key takeaways from current BTC trends:

🔹 Conviction buyers tend to spike at inflection points. In bear markets, they mark cycle bottoms. In bull markets, they stabilize pullbacks.

🔹 First Buyers (new capital) are essential for sustained uptrends. Recent spikes from July–Dec 2024 and Mar–May 2025 coincided with major expansions.

🔹 Momentum Buyers can sustain trends when other cohorts are flat. Their recent uptick signals growing short-term engagement.

Explore the full visualization in Glassnode Studio - available for BTC, ETH, and ERC-20 tokens: https://glassno.de/3SUoOu6

Glassnode’s latest visualization segments BTC, ETH, and ERC-20 token supply by investor type — based on real on-chain spending behavior. This lets you identify whether market moves are driven by:

→ Long-term conviction

→ New capital inflows

→ Short-term momentum

→ Panic selling

Three key takeaways from current BTC trends:

🔹 Conviction buyers tend to spike at inflection points. In bear markets, they mark cycle bottoms. In bull markets, they stabilize pullbacks.

🔹 First Buyers (new capital) are essential for sustained uptrends. Recent spikes from July–Dec 2024 and Mar–May 2025 coincided with major expansions.

🔹 Momentum Buyers can sustain trends when other cohorts are flat. Their recent uptick signals growing short-term engagement.

Explore the full visualization in Glassnode Studio - available for BTC, ETH, and ERC-20 tokens: https://glassno.de/3SUoOu6

To navigate market cycles effectively, it's not enough to track price. You need to understand who is driving those moves.

Glassnode’s latest visualization segments BTC, ETH, and ERC-20 token supply by investor type — based on real on-chain spending behavior. This lets you identify whether market moves are driven by:

→ Long-term conviction

→ New capital inflows

→ Short-term momentum

→ Panic selling

Three key takeaways from current BTC trends:

🔹 Conviction buyers tend to spike at inflection points. In bear markets, they mark cycle bottoms. In bull markets, they stabilize pullbacks.

🔹 First Buyers (new capital) are essential for sustained uptrends. Recent spikes from July–Dec 2024 and Mar–May 2025 coincided with major expansions.

🔹 Momentum Buyers can sustain trends when other cohorts are flat. Their recent uptick signals growing short-term engagement.

Explore the full visualization in Glassnode Studio - available for BTC, ETH, and ERC-20 tokens: https://glassno.de/3SUoOu6

Glassnode’s latest visualization segments BTC, ETH, and ERC-20 token supply by investor type — based on real on-chain spending behavior. This lets you identify whether market moves are driven by:

→ Long-term conviction

→ New capital inflows

→ Short-term momentum

→ Panic selling

Three key takeaways from current BTC trends:

🔹 Conviction buyers tend to spike at inflection points. In bear markets, they mark cycle bottoms. In bull markets, they stabilize pullbacks.

🔹 First Buyers (new capital) are essential for sustained uptrends. Recent spikes from July–Dec 2024 and Mar–May 2025 coincided with major expansions.

🔹 Momentum Buyers can sustain trends when other cohorts are flat. Their recent uptick signals growing short-term engagement.

Explore the full visualization in Glassnode Studio - available for BTC, ETH, and ERC-20 tokens: https://glassno.de/3SUoOu6

>>Click here to continue<<

Glassnode