Create: Update:

How do early token holders impact market trends?

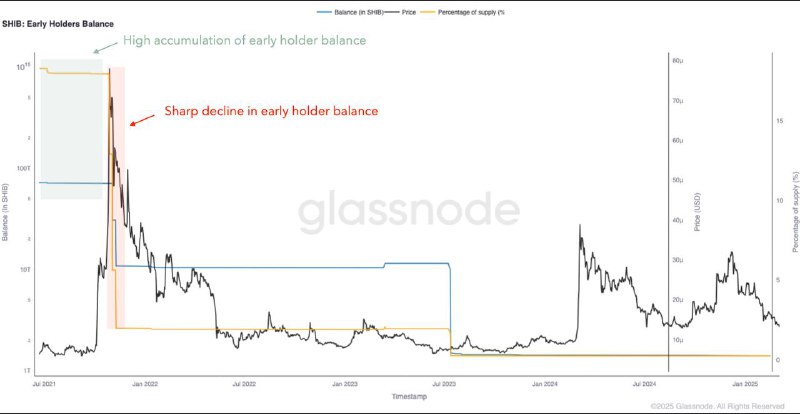

Early adopters often control a large share of a token’s supply, and their buying and selling behavior can strongly influence price movements.

Glassnode introduces a framework that helps traders anticipate market shifts by analyzing:

🔸Early Holder Balance – When are large holders selling?

🔸Herfindahl Index – How concentrated is token ownership?

🔸NUPL (Net Unrealized Profit/Loss) – Are early adopters still in profit?

🔸Cost Basis Distribution (CBD) – Where did early holders accumulate, and when do they distribute?

By using these insights, traders can detect profit-taking trends, time exits more effectively, and avoid sharp corrections.

Read the full research breakdown here.

Early adopters often control a large share of a token’s supply, and their buying and selling behavior can strongly influence price movements.

Glassnode introduces a framework that helps traders anticipate market shifts by analyzing:

🔸Early Holder Balance – When are large holders selling?

🔸Herfindahl Index – How concentrated is token ownership?

🔸NUPL (Net Unrealized Profit/Loss) – Are early adopters still in profit?

🔸Cost Basis Distribution (CBD) – Where did early holders accumulate, and when do they distribute?

By using these insights, traders can detect profit-taking trends, time exits more effectively, and avoid sharp corrections.

Read the full research breakdown here.

How do early token holders impact market trends?

Early adopters often control a large share of a token’s supply, and their buying and selling behavior can strongly influence price movements.

Glassnode introduces a framework that helps traders anticipate market shifts by analyzing:

🔸Early Holder Balance – When are large holders selling?

🔸Herfindahl Index – How concentrated is token ownership?

🔸NUPL (Net Unrealized Profit/Loss) – Are early adopters still in profit?

🔸Cost Basis Distribution (CBD) – Where did early holders accumulate, and when do they distribute?

By using these insights, traders can detect profit-taking trends, time exits more effectively, and avoid sharp corrections.

Read the full research breakdown here.

Early adopters often control a large share of a token’s supply, and their buying and selling behavior can strongly influence price movements.

Glassnode introduces a framework that helps traders anticipate market shifts by analyzing:

🔸Early Holder Balance – When are large holders selling?

🔸Herfindahl Index – How concentrated is token ownership?

🔸NUPL (Net Unrealized Profit/Loss) – Are early adopters still in profit?

🔸Cost Basis Distribution (CBD) – Where did early holders accumulate, and when do they distribute?

By using these insights, traders can detect profit-taking trends, time exits more effectively, and avoid sharp corrections.

Read the full research breakdown here.

>>Click here to continue<<

Glassnode